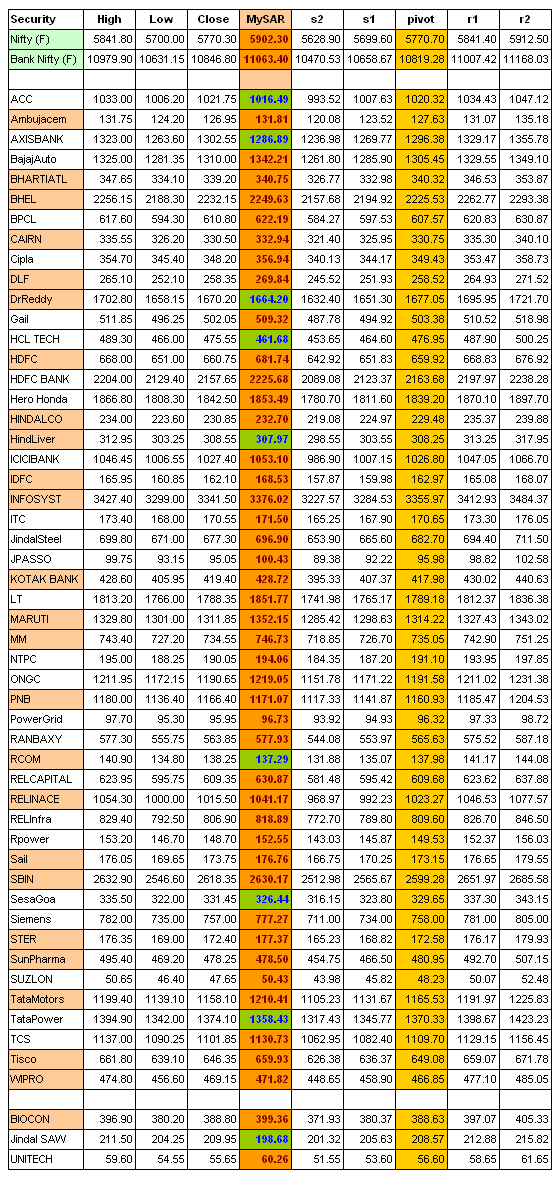

- Supp / Resisn SPOT/CASH LEVELS FOR INTRADAY

JB CHEMICALS (BUY)

- Stochastic is at 22 levels and it has given a buy crossover.

- RSI is showing a reversal trend after a sharp correction.

- MACD likely to show bullish crossover.

| CMP | Buy/Sell | Target Price | Stop Loss | Support/ Resistance |

133.35 | BUY | 135/138/151 | 130 | 120/160 |

HINDUSTAN ZINC (BUY)

- RSI is at 67 neutral territory showing positive crossover indicating uptrend.

- MACD is above zero line with a positive divergence.

- Stochastic is at 40 levels and it has given a buy crossover.

| CMP | Buy/Sell | Target Price | Stop Loss | Support/ Resistance |

1,371.85 | BUY | 1,385/1,405/1,425 | 1,350 | 1,320/1,470 |

MPHASIS (BUY)

- Stock already crossed 34 Day EWMA and expecting to rise further.

- MACD is likely to show bullish crossover..

- Stock next resistance level seems at 700 if its break then stock could rise up to 750.

| CMP | Buy/Sell | Target Price | Stop Loss | Support/ Resistance |

| 674.10 | BUY | 682/694/705 | 660 | 620/750 |

DEEPAK FERTILIZER (BUY)

- RSI is showing positive crossover supported with volume indicating further upside.

- MACD is crossing its signal line from below.

- Today stock has made new candlestick above 34 day EMA which is sign of uptrend.

| CMP | Buy/Sell | Target Price | Stop Loss | Support/ Resistance |

| 175.75 | BUY | 178/182/186 | 170 | 150/200 |

| Market Outlook | ||

Yesterday, Nifty opened higher and closed at 5,754.1 down by 8.75 points after making an intraday high of 5,842.6. On the daily chart, Nifty has formed a "Spinning top candlestick" pattern. After a sharp fall, a spinning top indicates momentum on the downside is losing steam and reversal in trend is likely. Today, Nifty is likely to open on a positive note following positive clues from global markets. Global stocks gained as US aluminum giant Alcoa kicked off the earnings season with forecast-beating results. Immediate Resistance for Nifty now seems at 5,820-5,840. On upside if level of 5,840 is breached decisively then short term (20DMA, 50 DMA and 100 DMA) moving averages placed at 5,993, 6,008 and 5,942 levels; may act as resistance for upside. Nifty has important support in 5,720-5,690 range, If Nifty hold support then short covering may be seen. In case of a breach of the 5,690 Nifty may test the lower 200 DMA which stands at 5,597. We can expect a pullback in market from this level or lower support of 5,700 level as Infosys may raise earnings forecast with the improving growth outlook for the US. Indian markets underperformed major global markets over the last few trading sessions. Interest rate sensitive sectors like banking, realty and automobile witnessed maximum selling pressure, amidst fears that rising inflation could stoke another round of interest rate hikes. However, the advance tax numbers were encouraging for the third quarter, clearly reflecting the continued good showing of Indian companies. Technical indicator MACD is crossing the signal line (9 Days exponential moving average) from the above, which is a bearish indication. However RSI and Stochastic are staying close to his oversold levels and likely to attract buying sentiment. All eyes will be on the IIP number today and Infosys' results on Thursday. | ||

| US markets | ||

| US markets closed higher as optimism of better quarter earnings report lifted sentiments. Markets started on upbeat note as investors reacted to quarterly results from aluminum giant Alcoa, which reported better than expected fourth quarter earnings after the close of trading on Monday. Alcoa posted fourth-quarter earnings of USD 0.24 per share, above analyst expectations for USD 0.19 per share. Revenues for the fourth quarter totaled USD 5.7 billion, up from USD 5.4 billion in the same period last year. Housing stocks edged higher after Lennar reported better than expected quarterly results. Lennar reported fourth-quarter earnings of USD 0.17 per share, well above expectations for earnings of USD 0.02 per share. Investors shrugged off the poor wholesale inventories data which edged down by 0.2% in November, while economists had expected inventories to increase by about 1%. | ||

| European markets | ||

| European markets rose as banks gained after Japan joins China to calm Eurozone debt crisis. Easing the European debt worries, Japanese Finance Minister Yoshihiko Noda said the country may buy more than 20% of the amount of European Financial Stability Facility bonds that will be initially issued later this month. Rise in copper prices coupled with brokerage update for BHP Billiton uplifted the mining companies. Siemens AG rose after the engineering company said its first-quarter profit and sales were set to surpass the year-earlier figures on robust factory demand. | ||

| Indian markets (Prev Day) | ||

| The domestic market today closed marginally lower the baseline, thus breaking its past few days of downward rally. The volatility remained the mantra for the day with the key benchmark indices swinging in a see saw manner since the initial bell. The investors turned a bit calculative ahead of the outcome of the Industrial Output (IIP) data scheduled tomorrow and the inflation data the very next day i.e. on Thursday. Meanwhile, the IT stocks remained on the seller's radar ahead of the earnings result from IT bellwether Infosys, which is scheduled to announce its quarterly figures on Thursday this week. However, the investors showed some buying interest in the banking and PSU stocks as both the indices are up by more than 1% each. The banking sector is up after the release of earnings estimates for the banking stocks by analysts which are quite optimistic. The domestic market belled the day's trade on a positive note and soon the benchmark indices fell below the baseline on profit booking across selective counters. But it again regained strength and recovered from the fall and kept on trading on a zig zag manner above the base line for the most part of the day expect in the final hour, which led extreme selling pressures across key indices, which led the domestic bourses to fell below the base line for the second time in the day to touch fresh intraday lows. However, some buying at lower levels towards the fag end of the session led the benchmark indices to recover from the negative zone but finally closed the day with minimal losses. On the sectorial front, Realty, IT, Teck remained on the sellers' radar while some buying momentum was witnessed across Bankex and PSU. At the end, Sensex closed at 19,196.34 down by 27.78 points. It touched an intraday high of 19,431.56 and low of 19,003.60. Nifty ended at 5,754.10 down by 8.75 points. It made a high/low of 5,842.60 and 5,698.20 respectively. | ||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Top | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||